Gartner Market Guide”Content Collaboration” 2020

23. Juni 2020 08:09 Uhr | Dr. Ulrich Kampffmeyer | Permalink

Die Gartner-Analysten Michael Woodbridge, Marko Sillanpaa und Lane Severson haben am 11.05.2020 einen Marktführer zu Unternehmen mit “Content Collaboration- Tools” veröffentlicht. Es stellt im Prinzip einen Auszug aus dem Gartner-Datenpool dar, der auch für Magic Quadrants und andere Auswertungen benutzt wird. Angesichts der durch Covid-19 bedingten Heimarbeit ist das Thema Collaboration brandaktuell. Der Report kann über verschiedene Anbieter wie z.B. SER kostenfrei gegen Überlassung der Kontaktdaten heruntergeladen werden.

In der Analyse geht es nicht einfach um Collaborations-Werkzeuge sondern Gartner hat den Fokus auf Content Collaboration gelegt. Dies fügt sich ein in die Strategie, ECM Enterprise Content Management nunmehr in CSP Content Services Platforms umzudefinieren. Dazu passt auch Gartners Ansatz mit dem Magic Quadrant für CCP Content Collaboration Platforms. So finden sich sowohl Anbieter aus dem (ehemaligen) ECM wie auch aus dem klassischen Groupware und Collaboration-Umfeld wieder.

Gartner sieht Content Collaboration als den Kern von neuen Arbeitsplatzlösungen an, den “New Work Nucleus”. Content Collaboration wird sowohl in lokalen wie auch besonders in Heimarbeits- und Unterwegs-Arbeitsplatzszenarien als wichtig betrachtet. Gartner ist der Meinung, dass der Markt für solche Werkzeuge matur ist und die Anbieter sich nun in verschiedene Richtungen diversifizieren. Besonders haben Cloud-Angebote für eine weiträumige Verbreitung und Akzeptanz gesorgt. Collaboration Tools gelten in vielen Unternehmen heute als Standardwerkzeuge. Hierbei ist allerdings zu berücksichtigen, dass enger gefasste Content Collaboration Werkzeuge nicht gleich Collaboration-Lösungen wie z.B. Teams sind, auch wenn aktuell Microsoft ebenfalls den Begriff Content Services versucht mit Leben zu füllen.

Gartner definiert den Markt wie folgt [Zitat]:

“Market Definition

Content collaboration is a key component of the new work nucleus. Content collaboration tools provide a modern replacement for the file system and help employees access and use content in their day-to-day activities. Core features include file sharing, device synchronization and the provision of collaborative workspaces. Another major benefit of content collaboration is that it opens up new paths of collaboration with customers, partners and suppliers. Therefore, appropriate protections must be in place, as security and privacy controls are a major concern of organizations. There are many providers of content collaboration tools, and they vary considerably in size, geographic coverage and industry focus. Functional differentiators, however, can be hard to identify.

Market Description

The market for content collaboration software and services has changed significantly over the past three years. Leading vendors, such as Box, Dropbox, Google (Drive) and Microsoft (OneDrive), have evolved their products from their enterprise file synchronization and sharing (EFSS) roots into richer content collaboration platforms (CCPs). EFSS technologies, and lately CCPs, have played a fundamental role in supporting modern remote-working patterns, an area of enormous importance. The market has matured quickly, however, and product differentiation can be difficult to find, at least in terms of features. Common features include collaboration workspaces, simple workflow capabilities and more granular security features. Gartner retired its Magic Quadrant for CCPs partly because of this lack of differentiation (see “Gartner Retires ‘Magic Quadrant for Content Collaboration Platforms’”). Additionally, Gartner now refers to this market as the content collaboration tool market (rather than the content collaboration platform market) because this technology is not always deployed as a platform.This Market Guide focuses on tools that support content collaboration. These tools are typically deployed in two ways. The first is as a foundational platform. Gartner’s ACME (Activity, Context, Motivation and Enabling) framework (see “How to Select Collaboration Technology Using Gartner’s ACME Framework”) describes the role of foundational technology within an organization. Foundational technologies “support multiple employee productivity workloads and are made available across the enterprise.” Content collaboration tools are often deployed as foundational platforms to support all employees in their day-to-day work. This type of platform can support a range of use cases, the most common being:

- Storage infrastructure modernization — The transformation of network file shares.

- External collaboration — Collaboration with parties outside the organization, including suppliers and partners.

- Team workspaces — The provision of an activity-focused collaboration environment based around a project or goal. Increasingly, these features are being provided through integration with workstream collaboration software.

- Content routing and approval — Utilizing lightweight workflow to route content for review, approval and sign-off.

- Process integration — Integration of collaboration endpoints with wider business processes, such as those for insurance claims and citizen registration.

The second way content collaboration tools are deployed is as situational or domain-specific applications (as identified in the ACME framework). This approach sees them deployed more like applications than broad platforms. The ACME framework defines domain technologies as “process and methodology-focused, and deployed for employees involved in those processes, programs or projects.” Situational technologies are even more narrow in their focus. They can include a collaboration environment to handle a range of use cases, for example:

- Fulfilling the marketing department’s need for interagency collaboration.

- Providing a collaboration and document review tool for engineers working in the field.

- Extending legal casework systems to clients and other partners.

The ease of procurement and deployment of content collaboration tools (most are SaaS platforms) means that they are often provisioned directly by business users and used for discrete teams, departments or projects. In this Market Guide we concentrate on content collaboration tools that are fairly general in terms of capabilities. In some cases, they may have a particular focus, such as an industry or certain user roles, but they generally have broad applicability. This makes them suitable as foundational components and domain/situational technologies. However, content collaboration can also take place in other, much more tailored tools that support very distinct use cases, such as corporate transactions, board meetings and system-to-system integration. These types of tool are almost always situational in their deployment and are not covered in this edition of this Market Guide.

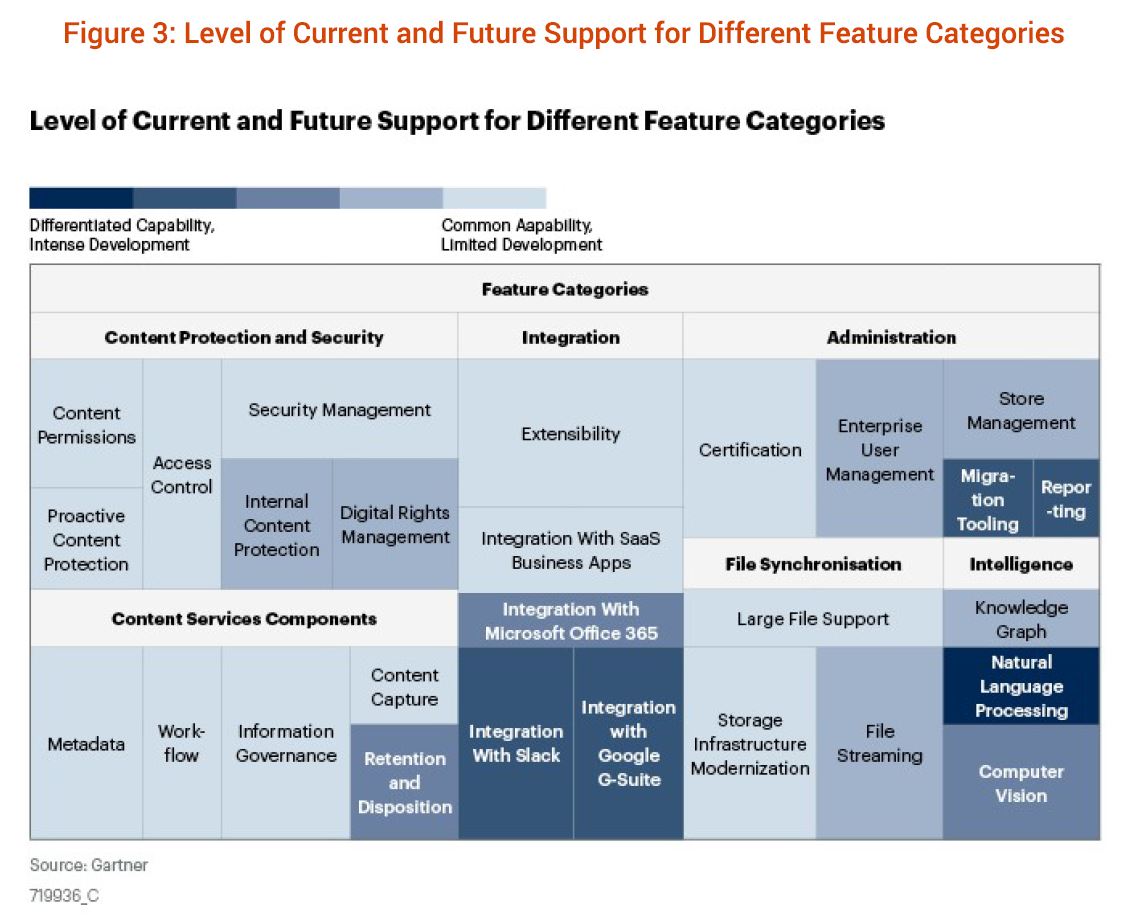

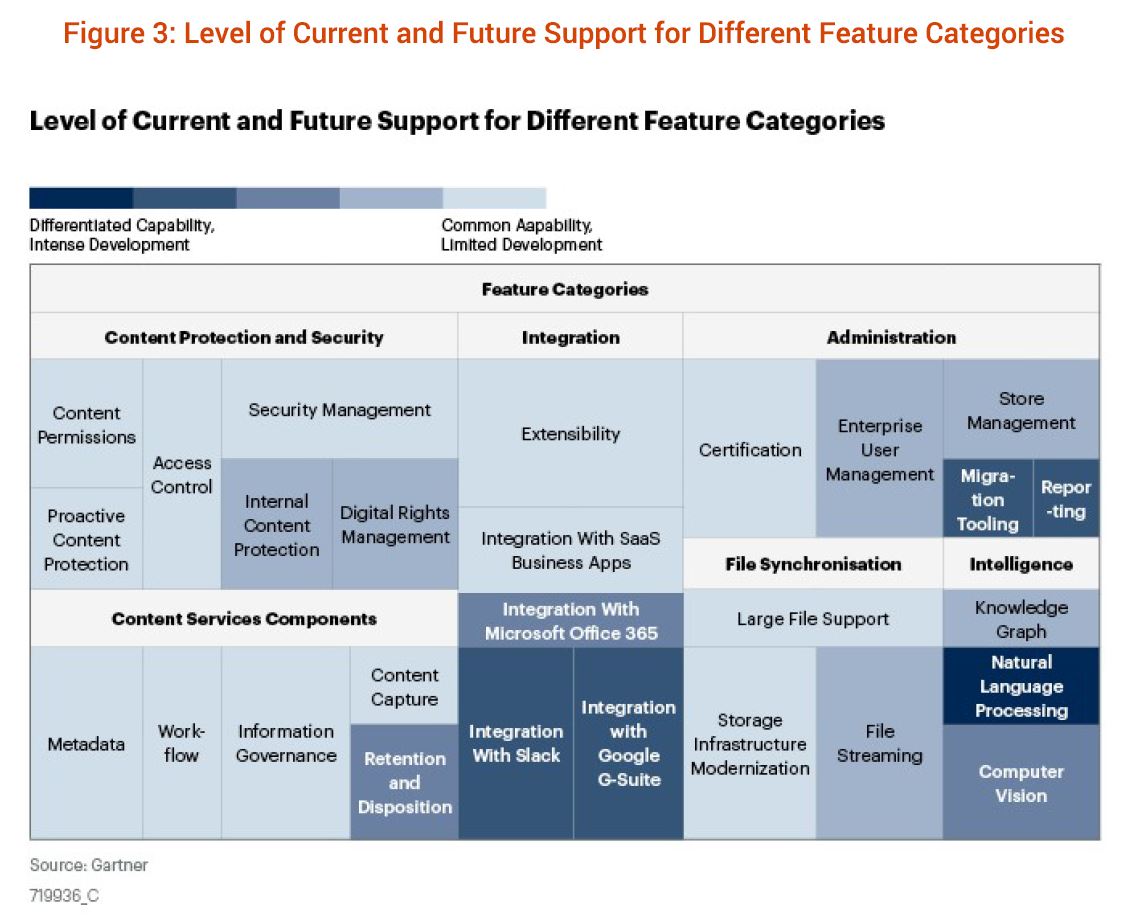

Aus der Markt-Definition ergibt sich eine recht vielfältige, kaum von anderen “Content”-Kategorien abgrenzbare Landschaft für Content-Services-Produkte. In einer Grafik hat Gartner die Eigenschaften und die Funktionalität zusammengefasst:

Die unterschiedlichen Grau- und Blautöne repräsentieren den aktuellen Verfügbarkeits- und Umsetzungszustand der Produkte. Je dunkler, desto mehr vorhanden.

Im Text der Studie sind die einzelnen Bedeutungen erklärt. In “Note 3 Product Feature Categories” gibt Gartner eine Übersicht der zugerechneten Funktionen und Eigenschaften.

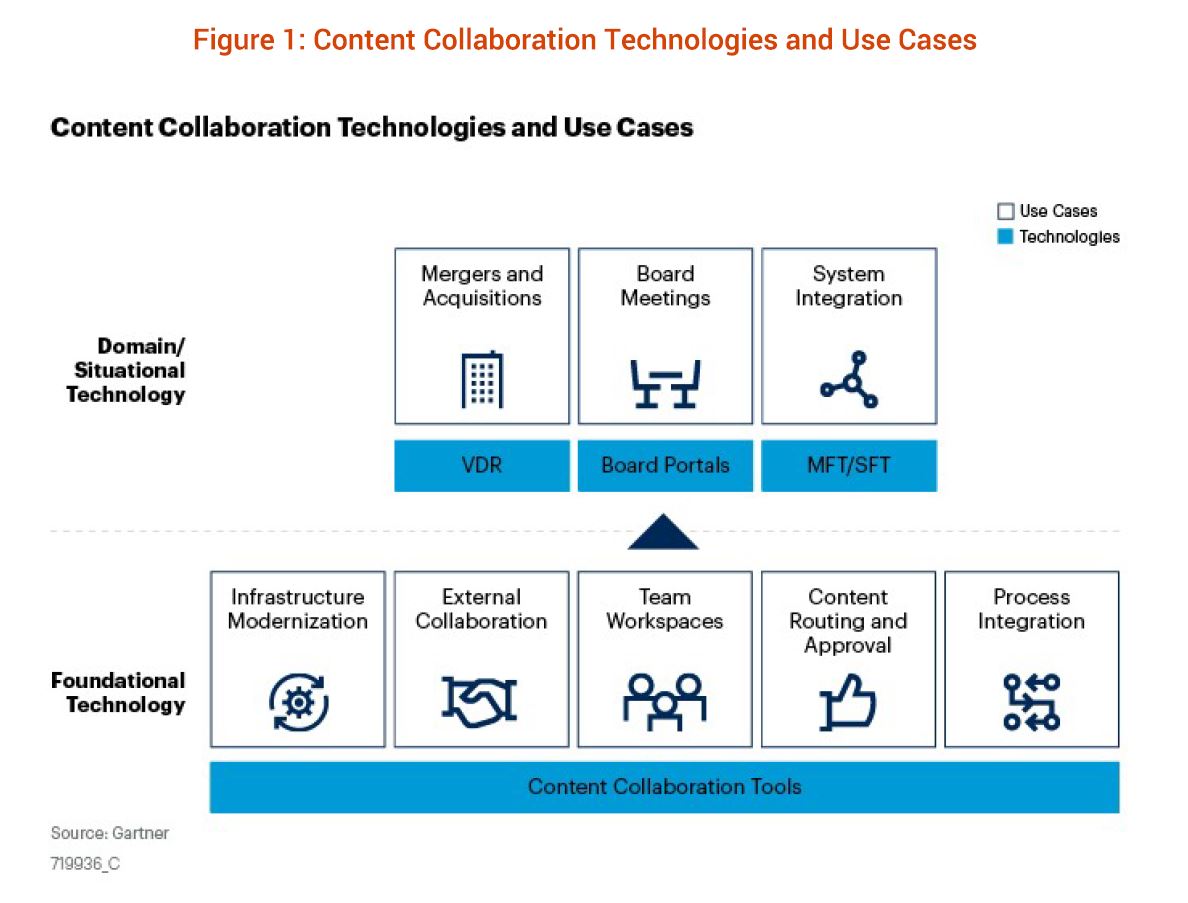

Vereinfacht sieht die Sicht auf die “Key Features” Content Collaboration Werkzeuge mit unterschiedlichen technischen Ansätzen und Anwendungsfällen dann so aus:

Dieser Ansatz nimmt zwar Elemente aus den (“definitorischen”) Bereichen von Content Services, ECM, EFSS und IIM auf, bietet aber nicht das vollständige Spektrum einer Collaboration-Anwendung mit Aufgaben-Management, Video-Conferencing, gemeinsames Bearbeiten von Dokumenten usw.. Dabei darf auch nicht vergessen werden, dass Collaboration schon immer ein wesentlicher Baustein von Enterprise Content Management war. Es sind nur neue Technologien und weitere Funktionalität hinzugekommen. Dies zeigt auch die Liste der “Key Features” [Zitat]:

“Gartner Reprint Key features of a content collaboration tool include:

- File synchronization: The basic ability to synchronize files across online services and devices.

- Content collaboration: The ability to share, and collaborate within, content in real time with colleagues inside and outside the organization.

- Content protection and security: The provision of granular levels of security and more advanced features, including mobile device and digital rights management.

- Content services components: Features associated with more process-driven content service platforms, such as metadata, workflow and retention management.

- Administration and implementation: Capabilities to control the administration of the platform and migration.

- Integration: Integration with other productivity-focused sources, including cloud office and workstream collaboration tools.

- Intelligence: Services to speed up productivity (for example, recommendations and suggestions) and data classification (computer vision and metadata entity extraction).“

Anbieter für Content Collaboration Werkzeuge

Gartner begründet die Auswahl der verschiedenen Anbieter und deren Produkte wie folgt [Zitat]:

“Representative Vendor Selection

The vendors in this Market Guide were selected to represent those with products that support most of the high-level capabilities mentioned in the Market Definition section, as well as most of the detailed functionality described in Note 3). In addition, their products are marketed and sold specifically as stand-alone content collaboration products, or as content collaboration modules in larger suites; and they are bought and used for this purpose. Finally, the listed vendors have achieved some degree of visibility and traction in this market.”

Die aufgelisteten repräsentativen Anbieter sind ein “wilder Mix” von ehemaligen ECM- und EFSS-Anbietern und Lösungen, die man schon immer zur Collaboration benutzte. Die Marktübersicht listet die Anbieter Aishu (AMPLIFY Content Services), Box (mit diversen Box-Produkten), Citrix (Citrix Content Collaboration), Dropbox (Dropbox Business), Egnyte (Egnyte), Google (Google Drive), Hyland (Sharebase), Inspire-Tech (EasiShare), Lenovo (Lenovo Filez), Microsoft (O365/OneDrive/Sharepoint-Kombi), owncloud (owncloud), SER Group (DoxiS4 iRoom), Thomson Reuters (HighQ) und Tresorit (Tresorit) auf. Andere Mitspieler wie IBM, OpenText etc. vermisst man in dieser repräsentativen” Übersicht. Die gelisteten Anbieter in eine Schublade packen zu wollen passt auch nicht. Die Tabelle ist in vielen Feldern leer geblieben und fokussiert auch Umsatz- und Installationszahlen – ordnet die Produkte aber nicht einzelnen funktionalen Kategorien zu. Immerhin hat es ein aus Deutschland stammendes (klasssisches ECM-) Unternehmen in die Liste geschafft: SER. Problematisch für alle aus dem ECM-Umfeld kommenden Unternehmen mit fehlender “Marktmacht” und Verbreitung ist die Situation, sich vielfach an Standard-Collaborations-Werkzeuge wie z.B. Microsoft Teams anzubinden oder zu integrieren. In dem Maße, wie diese Standardwerkzeuge weiterentwickelt werden, fallen auch immer mehr Argumente für solche angebundenen oder integrierten Zusatz-Tools weg. Große Unternehmen müssen inzwischen schon wieder entscheiden, welche Werkzeuge von welchem “Haus-Lieferanten” sie einsetzen. Hier herrscht häufig Redundanz bei der Funktionen – von Microsoft über SAP und Citrix bis hin zum Ausgebauten ECM.

Marktentwicklung

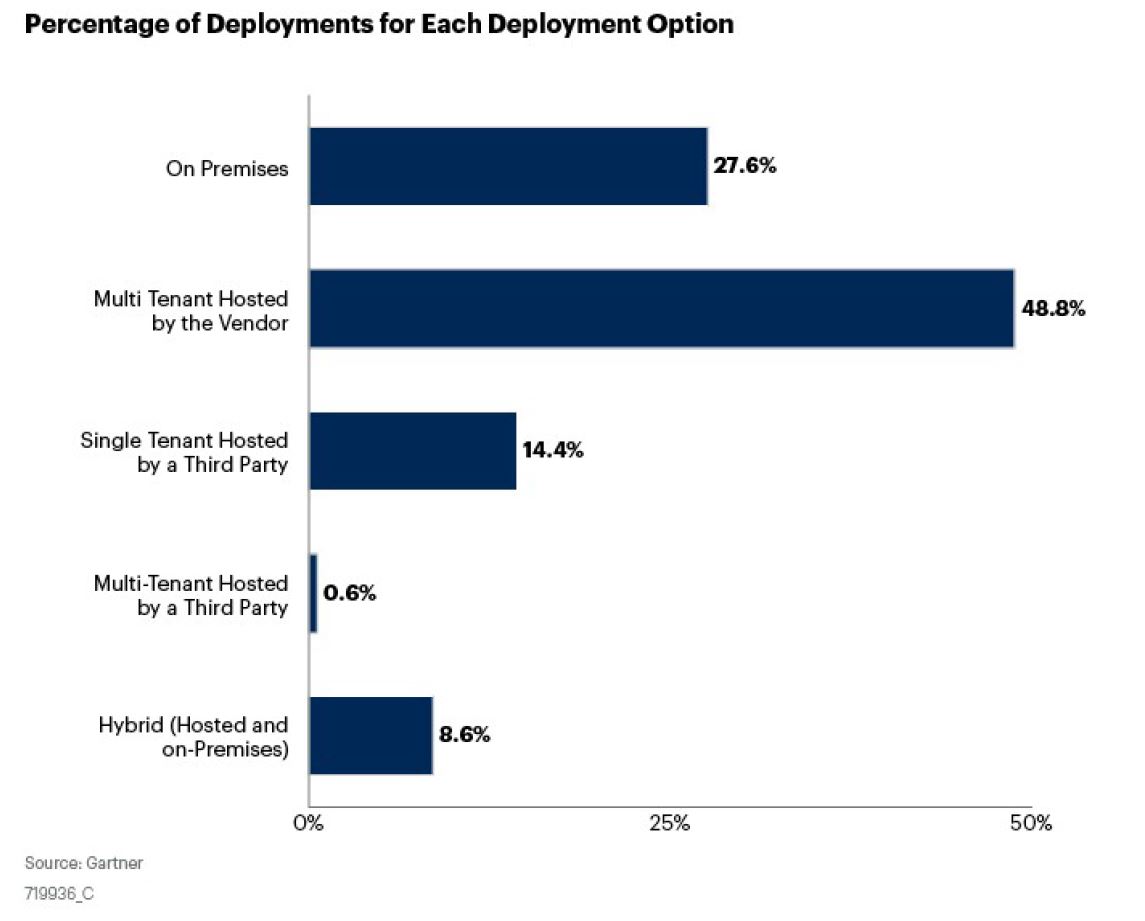

Die Abbildung 5 in Market Guide gibt einen guten Eindruck des Verhältnisses von On-Premise, Cloud und Outsourcing für Collaborations-Lösungen wider. gerade die Covid-19-Pandemie hat den Einsatz von Cloud-basierten Standardwerkzeugen beflügelt.

ECM-/Content-Collaboration-Anbieter ohne eigene Rechenzentren finden sich dann häufig in den Segmenten “hosted by a Third Party” wieder. In den fast 50% Anteil verstecken sich natürlich weit verbreitete Lösungen wie Microsoft. Der Anteil von On-Premise-Lösungen geht zurück. Dies ist nicht zuletzt durch gewisse Rückzugserscheinungen bei Lotus Notes und den Drang von Microsoft, alles in die Cloud zu bringen, begründet.

Im Abschnitt “Market Direction” gibt Gartner einen Überblick über die wichtigsten Trends [Zitat]:

“Market Direction

As the features of products in this market have become more commoditized, vendors have started to focus on bringing additional value to their platforms. There has been diversification and specialization in this market as vendors have sought to evolve and transform their products in different directions. The market for content collaboration tools has effectively fragmented, with vendors emphasizing a range of broader solution categories, including:

- Cloud office: Content collaboration embedded directly into broader cloud office services, such as Microsoft Office 365 and Google G Suite. We sometimes refer to cloud office suites as “the new work nucleus.”

- Consolidated workspaces: Embedded content collaboration within portal-like application workspaces as provided by Citrix Content Collaboration and Dropbox’s “Smart Workspace.” There is some similarity between the direction that vendors taking this route are pursuing and the functionality provided by workstream collaboration vendors such as Slack and Microsoft (Teams). However, this similarity is limited, and they also focus on providing integration with such tools.

- Content services platforms (CSPs): Richer content services focused on operational content use cases. Box and Microsoft have made significant headway in this area already, which is evident from their inclusion in the “Magic Quadrant for Content Services Platforms.” However, other vendors, such as Egnyte and Axway, can also be used to support more complex CSP-like use cases with the inclusion of metadata, governance and integration capabilities.

- Vertically aligned collaboration: Specialization in content collaboration for certain industries or use cases. HighQ’s focus on the legal and professional services market is a good example.

- Content protection: Solutions primarily designed to protect content as it moves into and out of an organization for collaboration purposes.

This specialization often means that content collaboration is a component of something else, most prominently a CSP. In addition to vendors with a CCP heritage, such as Box, providing richer CSP capabilities, almost all long-standing CSP vendors now provide content collaboration capabilities. Leading vendors such as Hyland and OpenText have had products offering these features for more than three years, but other vendors are also addressing these requirements. The fact that content collaboration is embedded in broader feature sets indicates that the need for it has not gone away. Content collaboration is at the heart of the “new work nucleus,” and organizations should include it as a key component of any IT modernization strategy. The stand-alone CCP has become less appealing as organizations implement content collaboration as a component of wider solutions. Therefore, Gartner expects the CCP market to continue to grow, but at a slowing rate.“

Zum Schluss hat Gartner im Abschnitt “Market Recommendations” dann noch eine Reihe von Empfehlungen für Anwender. Details entnehme man der Studie selbst.